Understanding Gambling Taxes: What You Need to Know

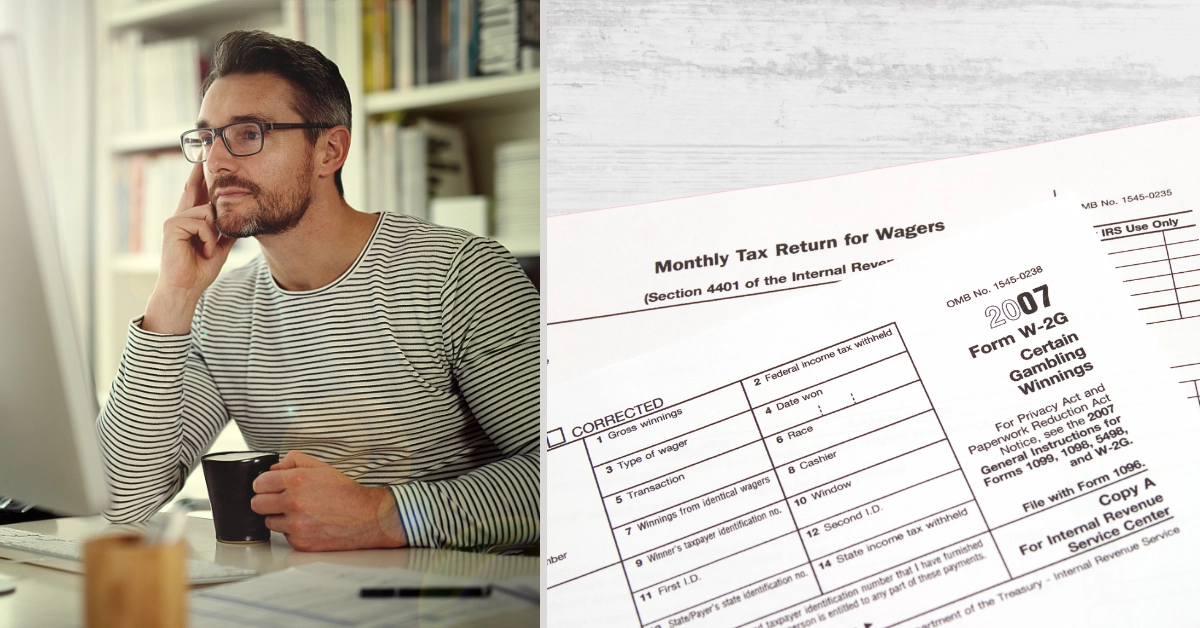

Did you hit the jackpot at the casino? Congrats!!! But hold up: before you go on a shopping spree to end all shopping sprees, you have to know how gambling taxes work. Unfortunately, the IRS gets a part of your gambling winnings—it’s like Uncle Sam is sticking his foot out to trip you while you’re doing your lil “I WON!” happy dance.

But it is what it is, and you have to pay the piper (the piper is the government in this scenario), so we are gonna walk you through everything you need to understand about gambling taxes. We’ll cover the basics you need to know, the types of taxes, how to report your winnings, state vs. federal, any deductions you might be able to claim, and some tips for managing it all. We’ll make sure you’re prepped and up to speed when April 15 comes a callin’!

Basics of Gambling Taxes

Look, I barely understand regular taxes (that’s what CPA’s are for), so it can get really confusing when you add in gambling winnings, but we have to figure it out so you aren’t surprised when tax season hits! So you can keep your finances and winnings in order, we are going to break it down into bite-sized pieces. We’ll get through this together!

Gambling taxes are simply that—taxes levied on the money you win from any gambling activities. This means everything from casino games and scratch-off lottery tickets to horse races and even TV game shows! The IRS sees all gambling winnings as taxable income, which means they have to be reported on your tax return. If you win really big, the casino or gambling establishment will even give you a Form W-2G, which reports the amount of your winnings to both you and the IRS.

Why Are Gambling Winnings Taxed?

The reason gambling winnings are taxed boils down to one simple principle: income is income. The IRS considers all forms of income as taxable unless it is specifically exempted by law, and this includes any and all money won from gambling. By taxing gambling winnings, the IRS is enforcing that all sources of income are treated equally under the tax code. This is in the name of fairness and verifies that everyone pays their fair share, whether their money comes from a job or a lucky streak at the physical casino or on an online gambling site.

Gambling taxes are just a part of the tax system designed to capture all forms of income, helping fund government services and ensuring equity among taxpayers, and understanding them is super important in order to stay compliant and avoid any unexpected bills from the IRS.

Types of Gambling Winnings That Are Taxable

Grasping the different types of taxable gambling winnings is a must for staying on the right side of the Internal Revenue Service. Below are the rules of taxable gambling winnings and what you need to know about each one!

Casino Winnings

Casino winnings come from the games in a casino, both physical and online. Things like slot machines, table games (blackjack and poker), roulette, baccarat, etc. If you hit the jackpot on a slot machine or win big at a table game, the IRS wants its cut. Casinos are required to issue a Form W-2G if you win the following:

- $1,200 or more from a slot machine or bingo game.

- $1,500 or more from Keno.

- $5,000 or more from a poker tournament.

Even if your winnings are below these amounts, you still have to report all gambling winnings as income on your tax return. If you win $800 on a slot machine, you won’t get a Form W-2G, but you still have to report it to the IRS.

But wait, there’s more! You don’t get to skate on taxes if you win on these games:

For baccarat, craps, and roulette, the IRS requires the casinos to report winnings above certain thresholds using Form W-2G. Here are the general guidelines for these games:

Baccarat: For table games like baccarat, where the winnings are not subject to a direct bet-to-win ratio, there is no specific threshold for issuing Form W-2G. However, if you win a large amount (typically over $600), it may still be reported, and taxes would still apply. The casino may not automatically issue a W-2G for table games, but it’s your responsibility to report any winnings.

Craps: Similar to baccarat, craps winnings do not have a specific threshold that requires a W-2G form. However, substantial winnings should be reported on your tax return. It’s your responsibility to keep track of your winnings and report them, even if the casino does not issue a form.

Roulette: Like baccarat and craps, roulette does not have a specific reporting threshold for issuing a W-2G form. Large winnings still need to be reported, but the casino is not typically required to issue a form unless the payout is large.

In general, while the IRS does not mandate specific reporting thresholds for these table games, all gambling winnings are taxable and should be reported on your tax return. If your winnings are substantial, the casino could choose to report them to the IRS and may withhold a portion of your winnings for federal tax purposes. It’s important to keep detailed records of all your gambling activities, including wins and losses, to report your income and claim any allowable deductions accurately.

Lottery Winnings

Lottery winnings, whether they are state or national lotteries, are considered taxable income. If your winnings exceed $5,000, the lottery organization will withhold federal taxes before you get your money. However, even if your prize is smaller, it still has to be reported on your tax return. Non-cash prizes, like cars or vacations, are also taxable based on their fair market value, and you must report the value of these prizes to avoid any penalties.

Sports Betting

Winnings from sports betting are taxable—and it doesn’t matter if your bets are placed online or at a physical sportsbook. If you win $600 or more from a single bet, a Form W-2G will be issued, but once again, you are required to report all of your sports betting winnings, regardless of the amount. Keep detailed records of all your bets and winnings so you can accurately report them!

Online Gambling

The convenience of online gambling has made it a go-to choice for so many gamblers, but, you guessed it, your winnings from online casinos, poker games, and other internet-based gambling activities are—shocker—taxable! The reporting requirements are similar to those for physical casino winnings. If your online gambling winnings go over certain thresholds, you will get a Form W-2G. Even if you don’t hit these thresholds, all winnings must be reported.

Other Forms of Gambling

There is no gray area if you’re thinking that some forms of gambling like raffles, horse racing, and Casual bets among friends, are safe from Uncle Sam. These winnings are also taxable and have to be reported.

- If you win $600 or more from a raffle or horse race, you need to include this income on your tax return.

- And winnings from friendly bets, like office pools or wagers between friends, are subject to taxation, too!

Reporting Gambling Winnings

Winning at gambling can be thrilling, but it’s important to understand the responsibilities that come with it, particularly regarding taxes. Properly reporting your gambling winnings is crucial to avoid any issues with the IRS. Below is an in-depth guide on what you need to know about reporting gambling winnings, the forms you’ll encounter, and the importance of meticulous record-keeping.

Reporting Requirements

The IRS requires that all gambling winnings be reported as taxable income. This includes money won from the following:

- Casinos

- Lotteries

- Raffles

- Horse races

- Sports betting

- Casual bets with friends/coworkers

Every type of gambling has specific thresholds that determine when you must report winnings and when you’ll receive a specific form like the W-2G:

- Slot machines and bingo: If your winnings are $1,200 or more.

- Keno: Winnings of $1,500 or more, after deducting the amount bet.

- Poker tournaments: Winnings exceeding $5,000 after deducting the buy-in amount.

- Other types of gambling: If you win $600 or more, the winnings are at least 300 times the wager amount.

Regardless of whether you receive a W-2G form, you must report all symptoms of your gambling winnings. This is necessary because even if your winnings fall below these thresholds, they are still considered taxable income!

Form W-2G

What is the form W-2G? Well, this doc is used to report certain gambling winnings to the IRS and is given to you by the gambling establishment in certain scenarios (usually larger winnings). This form is important for both the IRS and the taxpayer to make sure that the correct amount of tax is withheld and reported. Here’s how it works:

- Issuance: Gambling establishments are required to issue Form W-2G when your winnings exceed specific thresholds. For example, you’ll receive this form if you win $1,200 or more from a slot machine or bingo, $1,500 or more from keno, $600 on sports, or $5,000 or more from a poker tournament.

- Contents: The form details your winnings and the amount of federal income tax withheld. Federal taxes are typically withheld at a rate of 24% for substantial winnings, as indicated on the form.

- Multiple Forms: If you win at multiple establishments, each will issue a separate W-2G. You must report the amounts from each form separately on your tax return.

Other IRS Forms

When it comes to reporting any gambling winnings on your tax return, there are several forms that come into play:

- Form 1040: This is the primary form used for individual income tax returns. Gambling winnings should be reported as “Other Income” on this form.

- Schedule 1 (Form 1040): This form is used to report additional income, including gambling winnings if they are not directly reported on Form 1040.

- Schedule A (Form 1040): If you itemize deductions, you can report gambling losses on this schedule. However, it’s important to note that you can only deduct losses up to the amount of your winnings. For example, if you won $2,000 but lost $3,000, you can only deduct $2,000 in losses.

Record-Keeping

Keeping detailed records of your gambling activities is not just good practice; it’s vital for accurate tax reporting and compliance with IRS regulations. Proper documentation can also support any deductions you are able to claim for gambling losses. Here’s what you need to keep track of:

- Dates and types of gambling activities: Note the specific dates and types of games or activities you participated in. This helps verify the timeline and nature of your gambling.

- Locations: Record the names and addresses of the gambling establishments you visited.

- People present: Include the names of any people who were with you during your gambling sessions.

- Amounts won and lost: Keep all receipts, tickets, statements, and any W-2G forms you receive. This should include the amount of each bet, the amount won or lost, and any other relevant financial details.

- Other relevant documentation: Maintain records such as credit records, bank withdrawals, and statements that support your winnings and losses.

Accurate record-keeping not only helps in reporting your winnings correctly but also substantiates any deductions for losses you may claim. In the event of an IRS audit, having detailed records will be a lifesaver in justifying your reported amounts and deductions.

Deducting Gambling Losses

If you’ve had a rough night at the casino or lost a bet, there’s a little bit of good news: you can deduct your gambling losses on your tax return. But don’t smile just yet—the process comes with certain conditions and requirements that you have to follow to a “T” to claim these deductions in the right way.

Eligibility for Deduction

To be eligible to deduct gambling losses, you need to meet very specific criteria like the following:

- Itemize Deductions: You can only deduct gambling losses if you itemize your deductions on Schedule A of your Form 1040. This means your total itemized deductions have to exceed the standard deduction for your filing status.

- Winnings Limit: Your gambling losses can only be deducted up to the amount of your reported gambling winnings. For instance, if you won $4,000 but lost $5,000, you can only deduct $4,000.

- Record-Keeping: Maintaining detailed records of your gambling activities is a must! The IRS requires you to keep a diary or similar record that includes the date and type of each wager, the name and location of the gambling joint, the amounts won and lost, and the names of anyone present with you during the gambling activities.

How to Deduct Losses

Here’s a step-by-step guide on how to report and deduct your gambling losses:

- Report All Winnings: First, report all your gambling winnings as income on your tax return. This is done on Form 1040, specifically on the “Other Income” line.

- Itemize Deductions: Instead of taking the standard deduction, choose to itemize your deductions on Schedule A of Form 1040.

- List Your Gambling Losses: On Schedule A, under “Other Miscellaneous Deductions,” list your gambling losses. Remember, the amount you can deduct is limited to the amount of gambling income you reported. If your total itemized deductions are higher than the standard deduction, this will lower your taxable income.

- Professional Gamblers: If you are a professional gambler, your gambling income and losses are reported on Schedule C as a business expense. However, this designation is strictly defined by the IRS and involves proving that gambling is your primary source of income and that you practice it regularly and with continuity.

Documentation Required

To back up your gambling losses, you need to keep thorough records—aka receipts. Here’s what you should include:

- A Diary or Log: Keep a diary that records each gambling session, including the date, type of gambling, name, and location of the casino, amounts won and lost, and names of anyone who was with you at the time.

- Receipts and Tickets: Keep all receipts, tickets, statements, and any other documentation that can prove the amount of your losses. This could include wagering tickets, canceled checks, credit records, bank statements, and payment slips from the casino.

- W-2G Forms: For big winnings, you will get a Form W-2G from the payer, which details your winnings and any tax withheld. Keep all W-2G forms for your records and reporting.

Practical Tips

- Organize Your Records: Keep your gambling records organized and in a safe place. Create a filing system that allows you to access receipts, tickets, and your gambling diary easily.

- Regular Updates: Regularly update your gambling diary to make sure no details are missed. This will make it easier to report accurately at tax time.

- Consult a Tax Professional: If you engage in substantial gambling, consider consulting a tax professional. They can provide guidance tailored to your situation and ensure that you are in compliance with IRS requirements.

State vs. Federal Gambling Taxes

Knowing and understanding the tax obligations for gambling winnings at both federal and state levels is important for managing your finances! Below are examples of federal and state tax laws regarding gambling, along with some tips to avoid getting double-taxed.

Federal Tax Obligations

We know we keep saying it, but it has to be said: The IRS requires all gambling winnings to be reported as taxable income:

- Reporting Winnings: All gambling winnings must be reported on your federal tax return. This is done using Form 1040, specifically on the “Other Income” line. Significant winnings often come with a Form W-2G from the payer detailing the amount won and any taxes withheld.

- Withholding Taxes: Federal taxes are withheld at a rate of 24% for substantial winnings. This includes winnings of $1,200 or more from bingo or slot machines, $1,500 from keno, and $5,000 from poker tournaments.

- Deducting Losses: You can deduct gambling losses up to the amount of your winnings, but only if you itemize your deductions on Schedule A of Form 1040. This helps reduce taxable income but requires detailed record-keeping.

State Tax Obligations

State taxes on gambling winnings differ, with some states imposing their own tax rates and others not taxing gambling winnings at all. Here are examples from several states:

- California: Gambling winnings are taxed as personal income, with rates ranging from 1% to 13.3%, depending on the amount.

- New York: Winnings are subject to both federal and state taxes. New York’s state tax rates range from 4% to 8.82%, depending on the amount won.

- Nevada: Does not impose a state tax on gambling winnings, making it favorable for gamblers. However, federal taxes still apply.

- Illinois: Taxes gambling winnings at a flat rate of 4.95%.

- Florida: The state imposes a tax on gambling winnings over $5,000 at a federal rate of 24% but does not have a state income tax.

- Michigan: The state tax rate is 4.25% on gambling winnings.

- Mississippi: Levies a 3% tax on winnings from operators licensed under the Mississippi Gaming Control Act.

- New Jersey: State tax on gambling winnings is 3%, with additional withholding rates for lottery winnings from $10,001 to over $500,000.

- Pennsylvania: Taxes gambling winnings at a rate of 3.07%.

- Ohio: Licensed casinos must automatically withhold 4% of any winnings.

- Connecticut: Imposes a flat tax rate of 6.99% on gambling winnings.

Double Taxation

Double taxation happens when both federal and state governments tax the same income. Below is how you can manage or even (hopefully) avoid this:

- Credits for Taxes Paid: Some states offer credits for taxes paid to other states. This can help if you win in a state different from where you reside.

- Reciprocal Agreements: Some states have reciprocal agreements where they do not tax each other’s residents. Check if such agreements exist between the states where you live and gamble.

- Consulting a Professional: Getting advice from a tax professional can help you navigate these complexities, verify compliance with all tax obligations, and minimize the overall tax burden.

By understanding both federal and state tax obligations and taking appropriate steps to avoid double taxation, you can effectively manage your gambling winnings!

Special Situations

Special situations in gambling taxes involve unique rules and considerations for professional gamblers, non-residents who win in the U.S., and the impact of international tax treaties. Understanding these specifics helps in managing tax obligations effectively.

Professional Gamblers: Tax Rules Specific to Professional Gamblers

The IRS distinguishes between casual gamblers and professional gamblers, with different tax treatments for each. To qualify as a professional gambler, you must engage in gambling activities with the primary intention of making a profit and must do so regularly and continuously. The IRS uses a nine-factor test to determine if you meet this status, considering factors such as the manner in which you conduct your activities, your expertise, the time and effort you devote, and whether gambling is your primary source of income.

Benefits and Obligations

- Reporting Income and Expenses: Professional gamblers report their income and expenses on Schedule C of Form 1040, treating gambling as a business. This allows them to deduct ordinary and necessary business expenses, such as travel, lodging, and meals, directly against their gambling income.

- Deducting Expenses: Unlike casual gamblers, who can only deduct losses up to the amount of their winnings, professional gamblers can deduct all related expenses, potentially reducing their taxable income significantly. This includes travel expenses, tournament entry fees, and even the cost of research materials or software used to analyze games.

- Self-Employment Tax: Professional gamblers must pay self-employment tax, which covers Social Security and Medicare contributions. This rate is currently 15.3%, and professional gamblers need to make estimated tax payments throughout the year to avoid penalties.

- Record-Keeping: Maintaining meticulous records is a necessity. This includes a daily log of gambling activities, receipts, tickets, and any other documentation that can substantiate your income and expenses. Digital tools and software can aid in this process.

Qualifying as a Professional Gambler

Qualifying as a professional gambler is a challenge—you have to show that gambling is conducted in a business-like manner with the primary goal of making a profit. The IRS considers various factors, including the following:

- Businesslike Manner: Keeping detailed records and maintaining a separate bank account for gambling activities.

- Expertise: Demonstrating substantial knowledge and skill in gambling.

- Time and Effort: Devoting significant time to gambling activities.

- History of Income or Losses: Showing a history of making profits from gambling.

Tax Benefits and Requirements

Professional gamblers report their income on Schedule C, which allows them to deduct business expenses such as travel, meals, and research materials. However, they must also pay self-employment tax, requiring quarterly estimated tax payments to avoid penalties. Record-keeping is critical, and all gambling-related transactions should be meticulously documented!

Non-Residents: Tax Obligations for Non-Residents Who Win in the U.S.

Non-residents who win money from gambling in the U.S. are subject to different tax rules. Generally, gambling winnings by non-residents are subject to a 30% federal withholding tax. The gambling establishment withholds this tax at the source before the winnings are paid out.

Reporting and Compliance

- Withholding Tax: The gambling operator withholds 30% of the winnings at the time of payout. This is mandatory for non-residents and is meant to cover federal tax obligations.

- Filing a U.S. Tax Return: Non-residents may have to file a U.S. tax return to report their winnings and potentially claim a refund if too much tax was withheld. This requires obtaining an Individual Taxpayer Identification Number (ITIN) from the IRS.

- Exceptions and Reductions: Some exceptions may apply depending on the type of gambling. For example, non-resident aliens are not subject to withholding on winnings from blackjack, baccarat, craps, roulette, or big-6 wheel games.

Tax Treaties: Overview of International Tax Treaties

The U.S. has tax treaties with different countries that can affect how gambling winnings are taxed. These treaties can sometimes reduce or eliminate the 30% withholding tax on gambling winnings for residents of treaty countries.

Key Points of Tax Treaties

- Reductions and Exemptions: Some treaties provide for lower withholding rates or complete exemptions from U.S. tax on gambling winnings. The specifics depend on the terms of the treaty with each country.

- Claiming Treaty Benefits: To claim benefits under a tax treaty, non-residents must provide the necessary documentation, like a Form W-8BEN, to the payer to certify their eligibility for reduced rates or exemptions.

- Double Taxation Relief: Tax treaties also often include provisions to prevent double taxation, allowing taxpayers to credit taxes paid in the U.S. against their tax liability in their home country. This helps avoid being taxed twice on the same income.

Understanding the tax implications for professional gamblers and non-residents and the impact of international tax treaties is vital for managing gambling winnings effectively. Professional gamblers benefit from being able to deduct business expenses and must maintain detailed records and make estimated tax payments. Non-residents face a 30% withholding tax but may benefit from tax treaties that reduce or eliminate this tax.

Tips for Managing Gambling Taxes

Gambling is super exciting as a pastime, but it comes with tax responsibilities that can put a damper on that fun. But chin up! We have some comprehensive tips that will help you manage your gambling taxes and keep your finances in check.

Plan Ahead: Strategies for Managing Tax Liability

Planning ahead is an absolute must for managing your gambling tax liability. Below are the best strategies:

- Know Your Tax Obligations: ALL gambling winnings are considered taxable income and must be reported on your tax return. This includes cash prizes and the fair market value of non-cash prizes like cars and trips.

- Keep Detailed Records: Maintain thorough records of all your gambling activities. This should include the date and type of each wager, the name and location of the gambling establishment, the amounts won and lost, and the names of any other participants. Keeping detailed records will help you accurately report your winnings and losses.

- Use the Session Method: This method allows you to net your wins and losses within a continuous gambling session, which can lower your gross winnings and reduce the amount of taxes owed. For instance, a day’s worth of slot machine play or a single poker tournament can be considered one session.

- Estimate Your Taxes: If you frequently win small amounts that don’t trigger a W-2G, consider making estimated tax payments based on your projected annual winnings to avoid a large tax bill at the end of the year. Use Form 1040-ES for this purpose.

- Deduct Losses Correctly: You can deduct gambling losses up to the amount of your winnings if you itemize your deductions on Schedule A. Ensure that your total itemized deductions exceed the standard deduction to benefit from this. Only professional gamblers can deduct losses as business expenses on the Schedule.

Get Professional Help: When to Consult with a Tax Professional

Unless you are a financial whiz who does their own taxes for fun, consulting with a tax professional is always a good idea and can give you a leg up:

- Complex Situations: If you have extensive winnings or complex gambling activities, a tax professional can help you understand the intricacies of tax laws and ensure that you meet all reporting requirements. They can also advise you on state-specific tax laws, which may differ.

- Maximize Deductions: A tax professional can help identify all possible deductions and ensure that you are taking full advantage of them. For professional gamblers, they can assist in accurately reporting business expenses and netting winnings and losses.

- Avoid Penalties: Proper guidance can help you avoid underpayment penalties by ensuring timely and accurate estimated tax payments throughout the year.

- Audit Support: If you are audited, a tax professional can provide really valuable support, helping to gather necessary documentation and represent you during the audit process.

Use Technology: Tools and Apps to Help Keep Track of Gambling Activities

There’s an app for that! Make it easier on yourself by leveraging technology—it’ll simplify the process of tracking and reporting your gambling activities:

- Digital Logs: Use apps or software like QuickBooks or specialized gambling record-keeping apps to maintain a detailed log of your gambling activities. These tools can help you keep track of dates, types of wagers, amounts won and lost, and other necessary details.

- Cloud Storage: Store digital copies of your receipts, tickets, and other documents in cloud storage. This verifies that you can access your records from anywhere and protects them from being lost or damaged.

- Automated Reports: Most online gambling sites and casinos offer automated reporting tools to generate detailed statements of your activities. Use these reports to cross-check your records and ensure accuracy.

- Tax Preparation Software: Use tax preparation software like TurboTax, which can guide you through reporting gambling winnings and losses and ensure that you take advantage of all applicable deductions and credits.

By planning ahead, getting professional advice from a CPA, and using available technology to your advantage, you can manage your gambling taxes successfully and avoid any unwanted surprises or oopsies during tax season.

Final Words

Before you blow all your gambling winnings on a fancy new car or a bougie vacation, don’t forget that Uncle Sam will be waiting with his hand out come April 15. Yes, it rains on your parade, but it’s a necessary evil. Keep good records, plan ahead, and call in the pros if the tax forms look like hieroglyphics to you!

No, gambling taxes are not as glamorous as hitting it big at the craps table, but you still have to get it right. Keep meticulous records of your gambling activities, know the different types of taxable winnings, and be aware of both federal and state tax obligations. If things get complicated, call in a tax professional. They can make sure you’re maximizing your deductions while staying within the lines of tax laws.

Stay in the know and be proactive about your gambling taxes! Regularly update your records, make use of technology to simplify the tracking process, and consult with tax professionals if and when necessary. Keeping on top of these tasks will save you headaches when tax season rears its head and help you keep more of your winnings.

Additional Resources

Links to IRS Resources:

- IRS Topic No. 419 – Gambling Income and Losses

- Publication 525: Taxable and Nontaxable Income

- Publication 529: Miscellaneous Deductions

- Form W-2G and Instructions

- Form 1040 and Instructions

Further Reading:

- How to Pay Taxes on Gambling Winnings and Losses

- Tax Tips for Accountants with Gambling Clients

- Everything You Need to Know About Filing Taxes on Winnings

- Taxes on Gambling Winnings and Losses: 8 Tips to Remember

- What Happens If You Forgot to Report Your Gambling Winnings?

Matthew specializes in writing our gambling app review content, spending days testing out sportsbooks and online casinos to get intimate with these platforms and what they offer. He’s also a blog contributor, creating guides on increasing your odds of winning against the house by playing table games, managing your bankroll responsibly, and choosing the slot machines with the best return-to-player rates.